georgia ad valorem tax family member

Vehicles owned prior to March 1 2013. STATE OF GEORGIA GEORGIA HOUSE BILL 386 New Ad Valorem Title Tax TAVT HB 386 OCGA.

Vehicle Taxes Dekalb Tax Commissioner

A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted.

. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. New out-of-state residents will have to pay 3 percent of the vehicles worth. 48-5B-1 The motor vehicle portions of this bill provide as follows.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. E-File Free Directly to the IRS. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

PSA regarding Title Ad Valorem Tax when purchasing from immediate family member. The family member who is titling the vehicle has the option to pay the full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

E-FIle Directly to Georgia for only 1499. The family member who is titling the vehicle is. Veterans Exemption - 100896 For tax year 2021 Citizen resident.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. Georgia Title Attorney explains Ad Valorem Taxes. The family member who is titling the vehicle has the option to pay the full title ad valorem tax or continue to pay the annual ad valorem tax under.

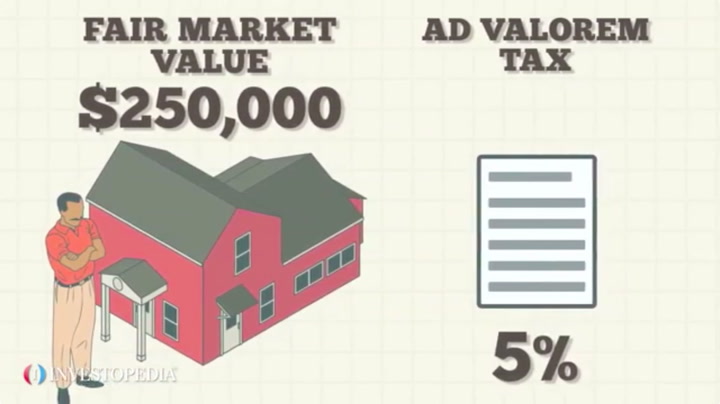

AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. This calculator can estimate the tax due when you buy a vehicle. And extended certain ad valorem tax exemptions to surviving spouses of military.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

2010 georgia code title 48 - revenue and taxation chapter 5 - ad valorem taxation of property. Ad Premium State Tax Software With All the Extras Included. Vehicles purchased on or after March 1 2013.

If a Georgia auto title is being transferred from one immediate. The other TAVT post reminded me of this. The family member who is titling the vehicle is subject to a 05 title ad valorem tax.

The Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure is on the ballot in. Vehicles passed between immediate family members spouses parents children siblings grandparents or.

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

16155 Belford Dr Milton Ga 30004 Realtor Com Belford Building A House Home And Family

![]()

Georgia New Car Sales Tax Calculator

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Atlanta Downtown Atlanta Beaches In The World

923 Buckingham Cir Nw Atlanta Ga 30327 Realtor Com Stone Houses Buckingham Ridgewood

Free Blank Printable Real Estate Promissory Note Word

Vehicle Taxes Dekalb Tax Commissioner

600 Doublegate Ct Canton Ga 30114 Mls 6697568 Coldwell Banker Coldwell Banker House Styles In Law Suite

National Register Of Historic Places Listings In Clarke County Georgia Wikipedia

Vehicle Taxes Dekalb Tax Commissioner

Property Overview Cobb Tax Cobb County Tax Commissioner

Commerce Ga Single Family Homes For Sale Realtor Com In 2022 Listing House Home And Family Patio